Questioning the Calculations |

College Promise Programs | Donate!

How Do Students Pay for College When Unmet Need Is So High?

Pulling back the veil that surrounds federal student aid reveals an unsightly truth: Student aid allocations are unlikely to be enough to cover college costs. Nearly three out of four students have unmet need. Unmet need is the out-of-pocket cost of college that students must come up with beyond expected family contribution, grants, scholarships, and work-study. Furthermore, the “expected family contribution” can be misleading to families and serves more as a rationing measure of available public funds than a scientific assessment of the student’s ability to pay. This gap in funding, the unmet need, begs the question: How in the world are students paying for college?

This is a critical question for policymakers, institutions of higher education, and the many organizations working to improve college access. Our best source of data to answer this question comes from the federal government’s National Postsecondary Student Aid Study. But this valuable resource is published only once every four years and the need for annual answers persists. One source for annual data is the Trellis Company’s Student Financial Wellness Survey (SFWS), a free-of-charge survey that helps schools plan how to stabilize students’ finances and create an environment where students can better reach their academic potential. Aggregate findings from nearly 39,000 students in the Fall 2019 SFWS (from 78 institutions in 20 states) reveal some interesting realities about how students pay for college.

This is a critical question for policymakers, institutions of higher education, and the many organizations working to improve college access. Our best source of data to answer this question comes from the federal government’s National Postsecondary Student Aid Study. But this valuable resource is published only once every four years and the need for annual answers persists. One source for annual data is the Trellis Company’s Student Financial Wellness Survey (SFWS), a free-of-charge survey that helps schools plan how to stabilize students’ finances and create an environment where students can better reach their academic potential. Aggregate findings from nearly 39,000 students in the Fall 2019 SFWS (from 78 institutions in 20 states) reveal some interesting realities about how students pay for college.

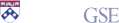

Most students use their current employment to pay for college. Around three in five students at two-year (61 percent) and four-year institutions (59 percent) work to pay for college.

Credit cards are common but come with uncomfortable risks. More than a quarter of respondents at two-year (27 percent) and four-year (29 percent) institutions report that they use credit cards to pay for college. Credit cards lack the protections that come with federal loans such as generous income-based repayment options, deferments, forbearances, and a lengthy period of delinquency before the loan is considered in default. Failure to promptly pay credit cards can result in hefty interest payments and penalties. Although many credit card users do pay their bills on time, many are not paying off their full balance. Sixty-one percent of credit card users at two-year institutions and 45 percent of credit cards users at four-year institutions disagreed or strongly disagreed that they fully pay off their balance each month.

Although less common than credit card borrowing, students also turn to payday and auto title loans. These loans carry extremely high interest rates and often use predatory marketing to target vulnerable populations. Seven percent of two-year respondents and four percent of four-year respondents reported taking out a payday loan in the prior 12 months. The same percentages of respondents also borrowed from an auto title loan during that time period.

Respondents at four-year institutions – and their parents – take out student loans at greater rates than students at two-year institutions. More than a third of respondents (35 percent) at two-year institutions indicated paying for college with student loans they took out for themselves compared with 63 percent of respondents from four-year institutions. Only five percent of respondents at two-year institutions reported that their parent(s) took out a student loan to help them pay for college, compared to nearly a quarter of respondents at four-year institutions (24 percent).

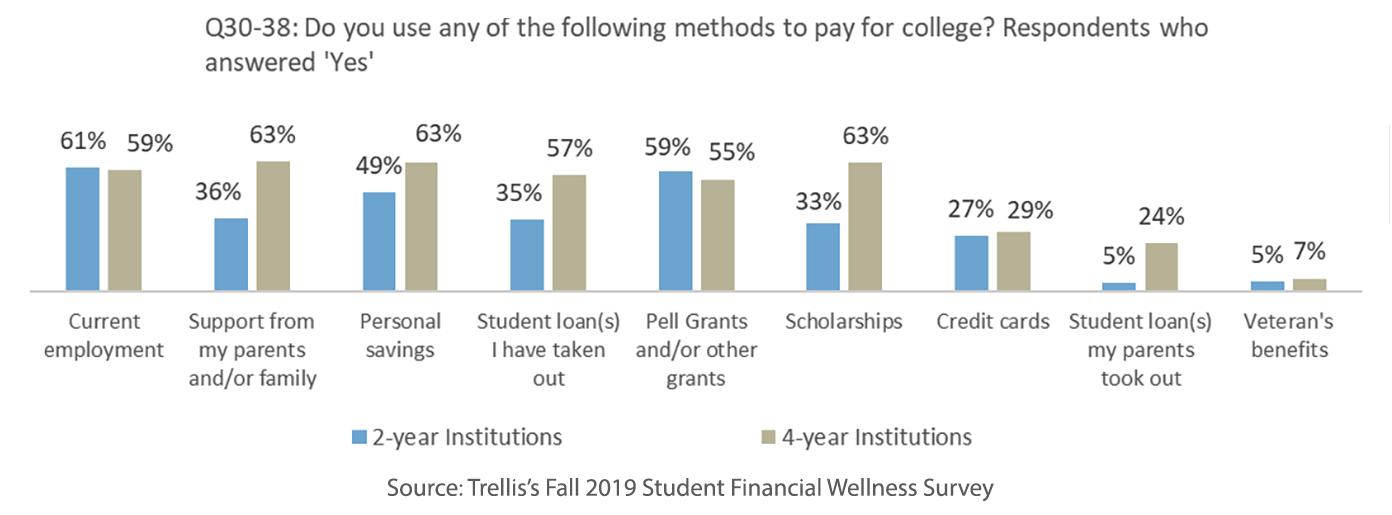

Many students who borrow have little confidence in their ability to repay. More than two-thirds of respondents who borrowed at two-year institutions (70 percent) and 73 percent at four-year institutions were not at all confident or only somewhat confident they would be able to pay off the debt acquired while they were a student.

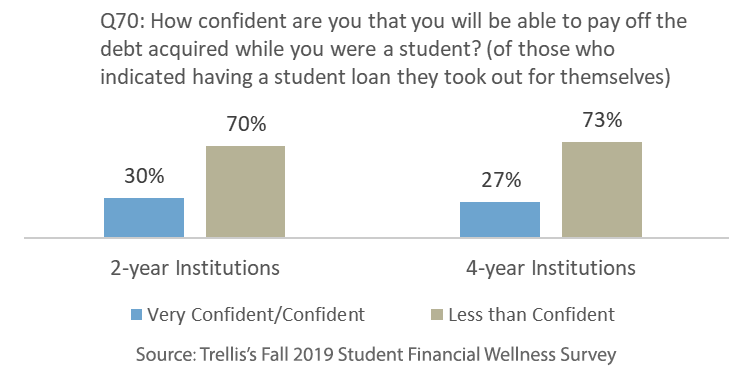

Even with the variety of sources students use to pay for college, many students still signal concern with being able to afford college. More than three in five respondents at two-year (61 percent) and four-year (70 percent) institutions agreed or strongly agreed that they worry about having enough money to pay for school. Respondents who were worried about having enough money to pay for school were more likely to be first-generation students, more likely to be under 25 years of age, and more likely to be female.

In addition to exploring the ways in which students are planning to fill in their gaps in funding, it is also important to understand that unexpected changes to funding sources, such as savings, parental contributions, and work opportunities, can also contribute to the challenges that students face. Job loss, illness, or other life changes can dramatically impact the ability to pay for college.

However, there are ways that institutions can better address these challenges. Some institutions help students create financial plans which complement their academic plans for degree completion. Financial plans can reduce stress for students, help students anticipate contingencies, and identify gaps in funding early in the process. Colleges have also seen measurable improvements in student success outcomes when students receive a combination of support services and financial resources that help address the financial challenges that many college students face.

A key to any institution’s strategic student success plan is to have the data to better understand the student experience. Surveys like Trellis’ Student Financial Wellness Survey and studies like the National Postsecondary Student Aid Study can help institutions better understand how students pay for college. When data suggest that those unmet need gaps are being filled with potentially risky financing tools about which students may be poorly informed, it’s a truth worth unmasking.